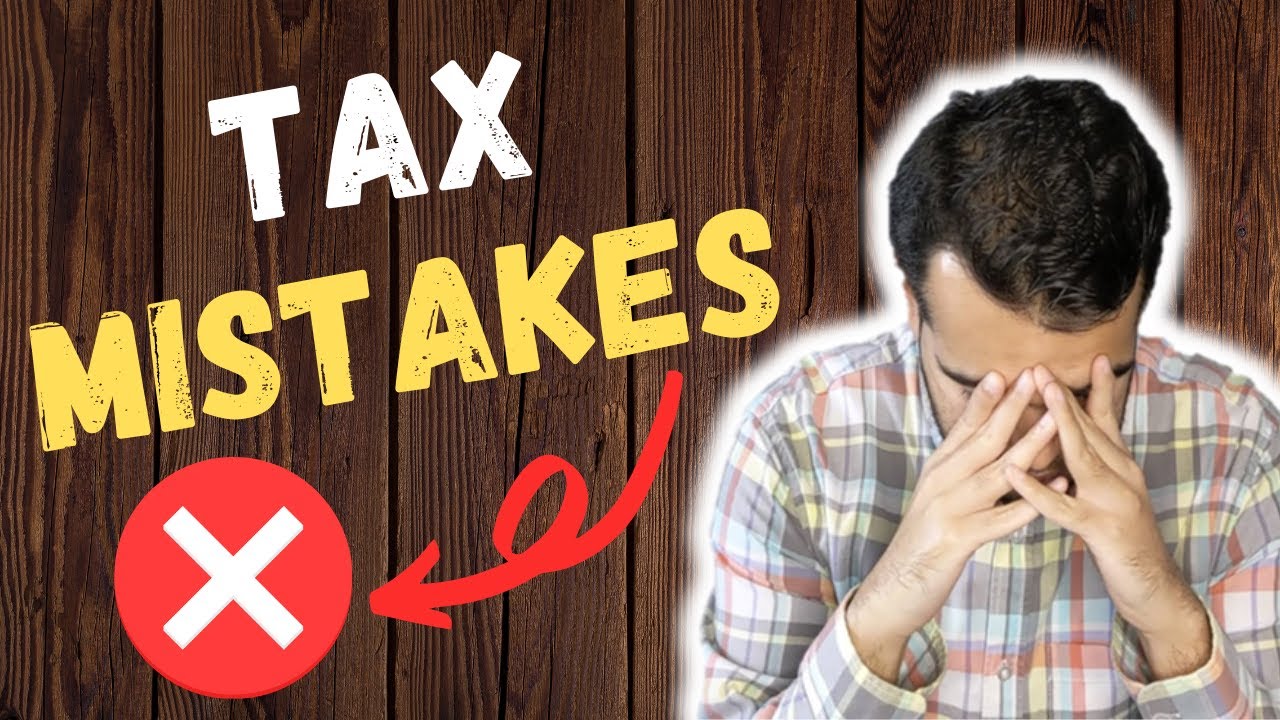

我们注册会计师团队提供全面的财税服务,

满足企业、个人和非营利组织的特定需求

确保您的公司和个人申报表符合法规,并最大程度地减少税务风险和降低您的税务负担。

立即联系我们,获得专业的税务申报修正服务。

我们拥有丰富的经验,能够帮助您顺利完成披露流程,并避免不必要的处罚。

RRSP-Registered Retirement Saving Plan (Registered Retirement Saving Plan)

At the beginning of each year, everyone asks themselves the same question: What should I do with my personal income tax? How can I pay less tax? How can I get more tax refunds? Should I buy an RRSP? How many RRSPs do I need to buy?

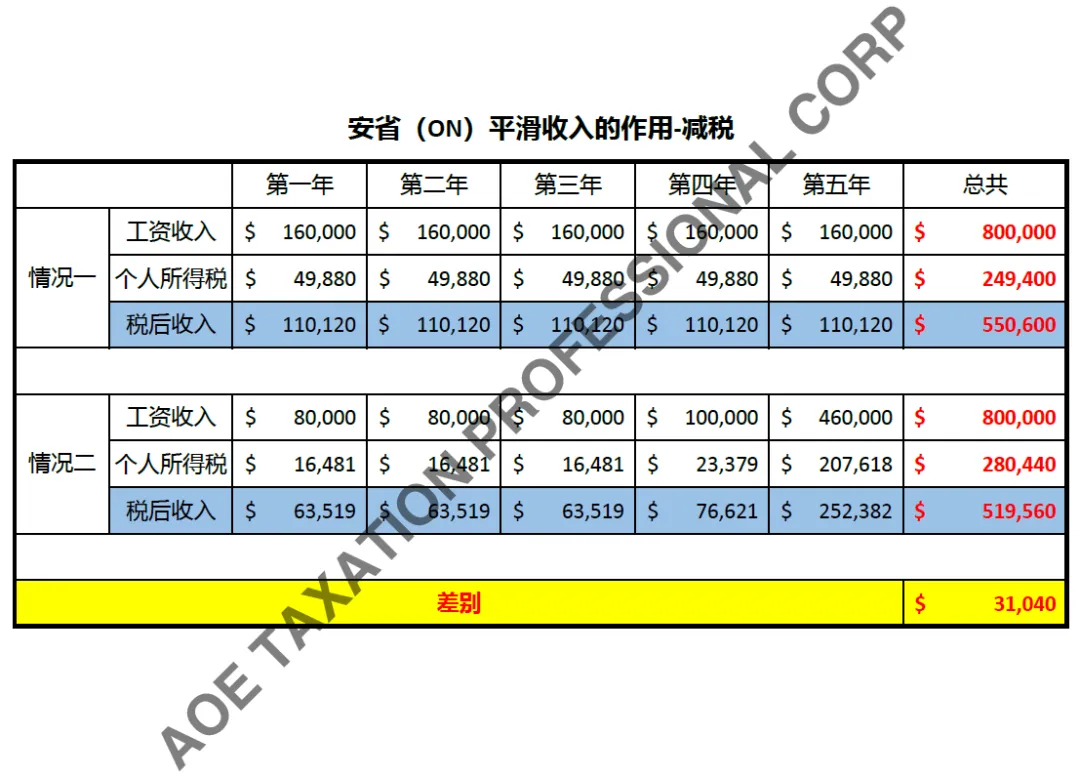

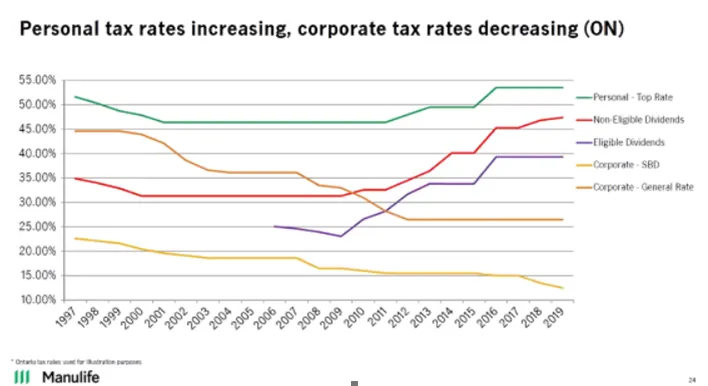

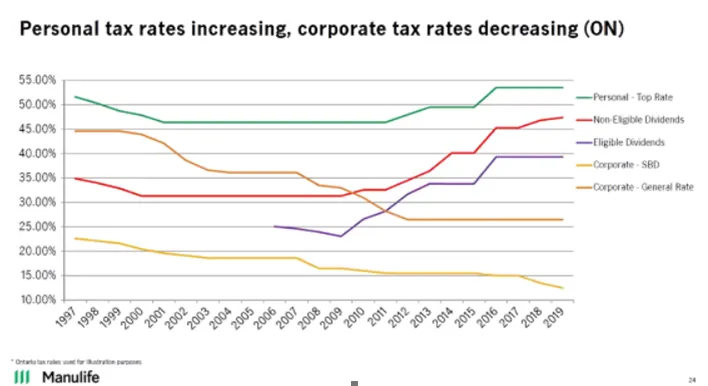

Everyone knows that Canada's tax rate is a progressive tax rate. The higher the income, the higher the tax payable. In 2019, the highest tax rate in Ontario is 53.53%, which means that if you reduce your income by 10,000 yuan, you will pay 5,353 less in taxes. It can be seen that buying an RRSP in a year with a high tax bracket can save a lot of tax.

Then there is another problem. What should I do with the interest and investment income generated by the RRSP?

Another advantage of RRSP is that all interest appreciation in the RRSP is tax-free. However, when withdrawing from the RRSP, it must be included in the income of the year. Most people's income after retirement is lower than before, so buying RRSP when the income is high in the working years can save taxes when the tax bracket is high, and withdraw it when the income is low, and pay taxes when the tax bracket is low.

As long as you have a SIN, have income, have reported taxes, have RRSP quota, and are under 71 years old, and meet these conditions, you can buy RRSP. Here, the editor would like to explain "what is income" in particular? According to Canadian tax law, income here refers to: "your salary income (T4 slip box 14), net income of self-employed persons (net income), net rental income of landlords (net rental income), government CPP/QPP disability payments, divorce alimony (spouse support), copyright income (royalty income), and non-tax residents in Canada's salary/business income". Special reminder that the income here does not include "investment income, pensions (DPSP, RRIF, OAS, CPP/QPP), retiring allowances, death benefits, taxable capital gains and limited-partnership income"

How much RRSP can be purchased? The amount of RRSP is determined by the "earned income" of the previous year and the upper limit set by the government, minus the pension adjustment (PA) given by the employer, and the lower number is the one. Purchase amount = last year's income multiplied by 18%. Every year, the government will set a "purchase limit", and the purchase limit set in 2019 is $27,230. The smaller of the two. In other words, if 18% of last year's income is greater than the upper limit set by the government, this year's amount is the upper limit of $27,230 set by the government; if it is less than the upper limit set by the government, it is calculated according to the smaller number. The calculation is too troublesome, the easiest way is to look up last year's Notice of Assessment (NOA), The amount (A) on the NOA is the amount for the next year. The amount for 2020 is marked on the 2019 NOA.

Important things should be emphasized three times: "Don't buy more than your RRSP, don't buy more than your RRSP, don't buy more than your RRSP". The CRA allows a lifetime maximum of $2,000 for over-buying. The over-buying in the current year (between $1 and $2,000) can be used to offset income in the next year. If you accidentally buy too much, there will be a 1% penalty per month for the amount exceeding $2,000.

What if you buy more than your RRSP and the amount is large? You must withdraw it as soon as possible, the sooner the better. You have to pay withholding tax when you withdraw it. At this time, please contact AOE Taxation. Our certified public accountants can help you submit a tax exemption application to the tax bureau. After the tax bureau approves it, you can withdraw the over-buying amount tax-free.

I would also like to remind everyone that you need to pay withholding tax whenever you withdraw your RRSP. This depends on the amount you withdraw.

Withdraw $5,000, the bank will automatically deduct 10%, and you will actually get $4,500;

Withdraw between $5,000 and $15,000, 20% tax will be deducted;

Withdraw more than $15,000, 30% tax will be deducted.

The RRSP you withdraw will be taxed together with your income for the year. If your personal tax bracket is higher than the withholding tax when you withdraw, you will have to pay another tax when you file your tax return. In addition, Withdrawing $5,000 from your RRSP does not mean that you have released the $5,000 RRSP quota. Don't buy an extra $5,000 RRSP next year on your own, or you will be fined. This happens all the time.

If you have RRSP quota but don’t have money to buy a house, you can save it for later use. Or if you know you may have to sell an investment property next year and get a lot of investment income, you can also save the RRSP quota for the next year.

There are a few more key points you must know

Finally, I would like to remind everyone to make tax planning as early as possible, save taxes and defer taxes reasonably. Don't work hard for the tax bureau for a year.

If you have any tax issues, the certified public accountants of AOE Taxation can help you!

Our phone number is 289-597-1869.

Welcome to add our WeChat customer service number for detailed consultation:

AOE Taxation customer service number - aoetaxation

RRSP-Registered RetirementSaving Plan(注册退休储蓄计划)

每年年初,每个人都会问自己同样的问题,我的个税怎么办?我怎么才能少缴税?我怎么才能多退税?我要不要买RRSP? 我需要买多少RRSP?

所有的人都知道加拿大的税率是递增税率,收入越高,应缴税额越高,2019安省最高的税率是53.53%,这就意味着如果你降低10,000元收入,就会少缴5,353的税。 可见,在税阶高的年份买RRSP的省税幅度大。

那么又有问题了,RRSP产生的利息和投资收益怎么办?

RRSP另一个优势就是所有RRSP内的利息增值是免税的。但是,RRSP提取的时候要计入当年的收入。 多数人退休后的收入低于从前,因此在有工作的年份收入高时买RRSP可在税阶高时省税,等到收入低时取出,在税阶低时交税。

只要你有SIN、有收入、报过税、有RRSP额度、不超过71岁的,同时满足这些条件的, 你就可以买RRSP 。在这里,小编要特别解释一下“什么是收入”? 根据加拿大税法规定,这里的收入是指:”你的工资收入(T4slip box 14), 自雇人士的净收入(netincome), 房东的净房租(net rentalincome), 政府的CPP/QPP 残疾金(disability payments), 离婚赡养费(spouse support), 版权收入(royalty income), 和非税居民在加拿大的工资/生意收入”。 特别提醒大家这里的收入不包括“投资收入(investment income),养老金(DPSP, RRIF, OAS, CPP/QPP), 退休补助(retiring allowances), 死亡保险金(death benefits),应缴增值 (taxablecapital gains)和 有限合作生意收入 (limited-partnership income)

那可以买多少RRSP呢?RRSP 的额度由上一年的 “earned income” 和政府制定的上限来决定,再减去雇主给的pensionadjustment (PA), 结果哪个数字低就是哪个。购买额度 = 去年的收入乘以18%。每年政府会规定“购买上限”,2019年规定的购买上限是$27,230。二者取小。 也就是说,若去年收入的18%大于政府规定的上限,今年的额度就是政府规定的上限$27,230;若算下来小于政府规定的上限,就按照小的算。 计算太麻烦,最简单的方法就是翻出去年的Noticeof Assessment (NOA), NOA上 “amount (A)” 标注的即是下一年的额度, 2019 NOA上标注的是2020的购买额度。

重要的事情强调三次,“RRSP不要买超,RRSP不要买超,RRSP不要买超” 。CRA允许一辈子买超的上限为$2,000.当年买超的(超出额在$1 – $2,000之间的) 可以留在下一年抵减收入。如一不小心买超太多,超出$2,000的部分每个月有1%的罚款。

万一买超了并且金额大怎么办?一定要尽快取出,越早越好,取出时要交withholding tax;这时候请联系AOE Taxation, 我们的注册会计师可以帮你向税局提交免税申请,税局批准后,可以免税取出超买的部分。

还要提醒大家,任何时候取RRSP的时候,都需要缴代扣税款。这个根据取出的金额有关,

取$5,000, 银行自动扣10%,实际到手$4,500;

取$5,000到$15,000之间,扣税20%;

取出$15,000以上,扣税30%。

取出的RRSP要加入当年的收入一起计税。如果个人的税阶已经高于取出时的withholdingtax, 报税时还要再补一笔税。另外, 取出$5,000 的RRSP并不意味着你 释放了这 $5,000的RRSP 额度,不要自作主张下一年多买$5,000的RRSP,会挨罚。这种事时有发生。

当年有RRSP额度但没钱买,额度可以积攒到以后用,或者你知道你下一年可能要卖个投资房,会有很多的投资收益,你也可以把RRSP额度攒到下一年度用。

还有几个关键点,你一定要知道

最后,还是提醒大家尽早的做好税务规划,合理的省税和延税。不要辛辛苦苦工作了一年全给税局打工了。

如果有任何税务问题AOE Taxation的注册会计师们可以帮您!

我们的电话是289-597-1869.

欢迎添加我们的微信客服号进行详细咨询:

信诚客服号 - aoetaxation

Many friends in Canada have rental income from renting out houses. So today, AOE editor will help you sort out what kind of expenses can be used to deduct housing taxes.

For example:

If the investment house is fully rented out, all the above expenses can be deducted from the income by 100%. If you only rent out part of your own house, you can only deduct part of all the expenses. After all, no one wants to be identified as an investment house by the tax bureau when selling the house to pay taxes.

There is another question that our accountants are often asked: A rents out a house to his children, but the rent is very low, so the house is losing money every year. A wants to use the loss of the house to offset his T4 income.

According to the tax bureau's regulations, if the loss of renting out to relatives is lower than the market price, it cannot be used to offset other income, and these losses can only be borne by oneself.

Of course, there are several special expenses that can be used to offset the income from renting out a house, such as car expenses and gift expenses. The deduction rules for these expenses are relatively complicated, so I won't go into details here. If you have any questions, you can add our WeChat account for consultation, or call us for consultation.

Our phone number is 289-597-1869.

Welcome to add our WeChat customer service number for detailed consultation:

AOE Taxation customer service number - aoetaxation

在加拿大有很多的朋友都有房屋出租的租金收入。那么AOE小编今天来帮大家捋一捋什么样的费用可以用来房屋抵税。

比如:

如果是投资房全部出租出去,以上所有费用100%可以抵扣收入。如果您只是把自家的一部分出租出去,那您只能抵扣所有费用的一部分,毕竟谁也不想在卖房子的时候被税局认定成投资房来交税的。

还有一个问题我们的会计师们经常被问到:A把房屋出租给了自己的孩子住,但是房租收的非常低,这样房子出租每年都在亏损。A想用房子的亏损在抵扣自己的T4收入。

根据税局的规定,如果低于市场价出租给亲属的亏损是不能来抵扣其他收入,这些亏损只能自己承担。

当然还有几项比较特殊的费用可以用来抵扣房屋出租的收入,比如汽车费用和礼物费用。这些费用的抵扣规则比较复杂,在这里,小编就不和大家细说了,有问题的,可以加我们的微信号咨询,或者打电话咨询。

我们的电话是289-597-1869.

欢迎添加我们的微信客服号进行详细咨询:

信诚客服号 - aoetaxation

Self-employment is a familiar yet unfamiliar industry in Canada. First, let's understand who can report self-employment income?

1. You have T4A slips

2. Although you don't have T4A, you have commission income

Next, AOE will tell you a few points to note about self-employment:

What expenses can be deducted from self-employment income?

Advertising expenses, catering and entertainment expenses, bad debt losses, commercial insurance premiums, commercial interest expenses, professional fees (accounting fees, legal fees, consulting fees, etc.), commercial taxes, commercial license fees, office expenses, rent expenses, employee wages, commercial property taxes, travel expenses, water, electricity and gas expenses, business car expenses, telephone charges, Internet charges, personal vehicle business car expenses, personal housing business house expenses, etc.

How to calculate the fees?

According to CRA regulations, each of the above fees has a specific calculation method based on the work performed by the self-employed. Due to limited space, I will not explain it here. If you have specific questions, please call us for consultation. Our phone number is 289-597-1869

Do you need to withhold and pay on your behalf?

Usually, self-employed people do not have to pay the federal unemployment insurance program (Employment Insurance) EI. However, based on their income, self-employed people must pay income tax and double CPP in advance or after filing tax returns. However, since January 2010, self-employed persons can apply for the federal unemployment insurance program (Employment Insurance) EI. Like employed persons, they can receive employment insurance benefits during maternity leave, sick leave, staying at home to take care of children, and receiving care. This is especially applicable to self-employed expectant mothers who are preparing to have a baby.

Do I need to keep receipts?

The longest prosecution period of CRA is 6 years, and all receipts need to be kept for at least 6 years. Special reminder: It is best to copy or scan receipts made of thermal paper to prevent the ink from falling off.

Do I need to apply for an HST account?

If the income from self-employment exceeds 30,000 Canadian dollars, you must apply for an HST/GST account and declare it as required. If your self-employed income is less than 30,000 Canadian dollars, you do not need to open an HST/GST account. However, UBER drivers and real estate agents must apply for an HST/GST account and declare it. Otherwise, CRA will impose a fine and interest, which is a result that no one wants to see.

In recent years, CRA has increased its tax inspection efforts, especially for self-employed people. Customers often ask how to deal with tax bureau audits. Here, AOE's certified public accountants remind everyone that in order to avoid or reduce the possibility of being investigated, the most important thing is to declare the expenses correctly and the relevant expenses must be reasonable. If you want to know what expenses can be declared and how much is reasonable, please contact us.

Our phone number is 289-597-1869.

Welcome to add our WeChat customer service number for detailed consultation:

AOE Taxation customer service number - aoetaxation

自雇在加拿大是一种让人熟悉又陌生的行业,首先我们先了解一下谁可以报自雇收入?

1. 你有T4A slips

2. 虽然你没有T4A, 但是你有佣金收入(commission)

接下来AOE给大家说一说自雇要注意的几点:

什么费用可以抵扣自雇收入?

广告费,餐饮娱乐费,坏账损失,商业保险费,商业利息费,专业费用(会计费,律师费,咨询费等),商业税费,商业牌照费,办公室开销,房租费用,雇员工资,商业地税,差旅费,水电气费,商业用车费用,电话费,网络费,个人车辆生意用车费用,个人住房生意用房费用等。

如何计算费用?

根据CRA的规定,根据自雇人员从事的工作,以上每个费用都有特定的计算方式,由于篇幅有限,就不在这里展开说明了,大家有具体的问题,欢迎电话咨询,我们的电话是289-597-1869

需要代扣代缴吗?

通常自雇人士是不用缴纳联邦失业保险计划(Employment Insurance)EI的。但根据收入,自雇人士须提前或报税后上缴所得税和双份的CPP。不过,自2010年1月起,自雇人士可申请加入联邦失业保险计划(Employment Insurance)EI,跟受雇人士一样可以在产假、病假、留家照顾子女及要接受照顾时,可领取就业保险金,这一点尤其适用于准备要BABY的自雇准妈妈们。

需要保留收据吗?

CRA的最长追诉周期是6年,所有的收据至少需要保留6年。特别提醒:热明纸的收据最好复印或者扫描保留,以防油墨脱落。

需要申请HST 账号吗?

如果自雇的收入超过3万加币之后,必须申请HST/GST账号并按要求申报。自雇收入低于3万加币,可以不必开通HST/GST账号,但是像UBER 司机,房产经纪必须申请HST/GST账号并申报,否则,CRA会罚款并罚息,这是谁也不愿意看到的结果。

近几年,CRA 查税的力度加大,特别是针对自雇人士。经常有客户咨询如何应对税局审计调查,在这里AOE的注册会计师特别提醒大家,为了避免或减少被查的可能,最重要的就是申报费用要正确,相关费用要合理。如果你想知道什么费用可以申报,多少费用是合理的,请联系我们。

我们的电话是289-597-1869.

欢迎添加我们的微信客服号进行详细咨询:

信诚客服号 - aoetaxation

Canadian tax residents must do two important things during tax season: declare global income and declare overseas assets. Today, AOE editor will explain how to declare overseas assets.

A Let's first briefly distinguish between assets and income

For example: I took 10,000 yuan to deposit in the bank, and one year later I took out all the money, 11,000 yuan. This 10,000 yuan is my principal, which is asset; 1,000 yuan is interest, which is income. For another example, I have a 600,000 yuan house in Beijing that I rent out to make money, and the annual rent is 30,000 yuan. The house is my asset, and the rent is my income. All income is taxable income, and assets are not income and do not need to be included in the total income. We will have another special article to introduce the investment income of assets.

B What are the basic conditions for declaration?

CRA stipulates that at any time in a year, as long as the total cost of holding overseas assets exceeds 100,000, it must be declared. If the overseas assets are between 100,000 and 250,000, you can choose to declare a simple declaration or a detailed declaration; if it exceeds 250,000, a detailed declaration must be made. The deadline for overseas assets and the personal tax declaration date are the same day, both April 30. If you submit an overseas asset declaration overdue, you will face a fine of $25 per day, up to a maximum of $2,500, and interest will be calculated separately. For newly landed immigrants, the total cost of overseas assets is the market price on the day he becomes a Canadian tax resident. CRA will give new immigrants one year to sort out their overseas assets, so there is no need to declare overseas assets in the first year after landing, and they must declare in the second year.

C Which overseas assets need to be declared?

1. Funds held outside Canada Funds held outside Canada

· Funds held in foreign bank accounts

· Funds held in other foreign institutions

· Prepayments on debit or credit cards, promissory notes, bills of exchange and other cashable instruments.

2. Shares of non-resident corporation (other than foreign affiliates)

· Shares of non-resident corporation (other than foreign affiliates)

· Shares of non-resident corporation refer to shares held by the individual and related persons that are less than the proportion of foreign affiliates

· Shares of foreign affiliate refer to shares held by the individual at least 1%, plus 10% or more held alone or together with related parties

· regardless of whether the actual holding is in Canada

3. Indebtedness owed by non-residents Debts owed by non-tax residents to tax residents

· Does not include debts owed by overseas subsidiaries;

· Whether held at home or abroad; issued by non-residents;

· Commercial bills, commercial bills, bank unsecured bonds, loans, mortgages, etc.;

· Time deposits, government bonds, etc.

4. Interests in non-resident trusts Interests in non-resident trusts

· Do not include non-resident trusts in overseas subsidiaries

· If there is additional investment, trust distribution received, and loans obtained from the trust, please report T1141/T1142

5. Real property outside Canada Properties outside Canada

· Does not include private properties (mainly used for personal family living)

· Does not include properties for business purposes (factories, warehouses, office buildings, etc.)

· Rental properties need to be declared

6. Other property outside Canada Other assets outside Canada

· Holding Canadian company shares overseas

· Holding overseas assets through a partnership system, but the partnership structure does not need to report T1135, individual reporting

· Life insurance that meets the definition of special overseas assets

· Rare metals or gold and silver coins held overseas

· Commodity or futures contracts, options or financial derivatives related to the above-mentioned overseas assets

· Any rights that may lead to the ownership, acquisition, and possession of interests in overseas assets

7. Property held in an account with a Canadian registered securities dealer or a Canadian trust company

· Assets held by Canadian securities companies or trust companies

· All assets held by one of the above companies should be aggregated by country name;

· Can be aggregated under the country name in different accounts;

· The highest market value during the year can adopt the highest end-of-month market value;

D Which overseas assets do not need to be reported?

Assets used for personal use overseas do not need to be reported, such as self-occupied homes, cars, jewelry, paintings and other collections.

Any overseas investments held in all registered retirement savings plans (RRSPs) and tax-free savings accounts (TFSAs).

If you have any questions about the declaration of overseas assets, please contact us. We will provide you with the most professional and comprehensive tax advice,

Please call: 289-597-1869

Welcome to add our WeChat customer service number for detailed consultation:

AOE Taxation customer service number - aoetaxation

加拿大税务居民到了税季都必须做两件大事:申报全球收入和申报海外资产。今天AOE小编先来讲解一下如何申报海外资产。

A 先简单给大家区分一下资产和收入

举个例子:我拿了1万块去银行存款,1年之后我把所有的钱取出来了1万1千块。这1万块钱就是我的本金也就是资产;1千块是利息也就是收入。再比如我在北京有一套60万的房子在出租赚钱,每年租金是3万元。房子就是我的资产,而租金就是我的收入。所有的收入都是应税收入,而资产不是收入不需要计入总收入。资产的投资收益我们会另有专门的文章介绍。

B 什么是申报的基本条件?

CRA规定在一年中的任何一个时间点,只要持有海外资产的成本总额超过10万,必须申报。海外资产在10-25万之间,可以选择简单申报或详细申报申报;超过25万的必须是详细申报。海外资产的截至日期和个人税的申报日期是同一天,都是4月30日。超时提交海外资产申报,将面临每天$25,最高为$2500的罚金,利息另计。对于新登陆的移民,海外资产的成本总额就是他成为加拿大税务居民当天的市场价。CRA会给新移民一年整理自己海外资产的时间,所以登陆后第一年无须申报海外资产,第二年才必须申报。

C 哪些海外资产需要申报?

1.Funds held outside Canada 加国境外资金

· 国外银行存款帐户中的资金

· 国外其它机构中的资金

· 借记卡或信用卡上的预付款,本票,汇票等可兑现的票据。

2.Shares of non-resident corporation (otherthan foreign affiliates)

· 非居民公司持股(而不是海外附属公司的)

· 非居民公司股指本人及关联人持股不到海外附属公司比例的股

· 海外附属公司股指本人至少持股1%,加上单独或同关联方一起,持有10%或以上

· 不管实际持有是否在加拿大

3.Indebtedness owed by non-residents 非税居民欠税务居民的债务

· 不包含海外附属企业的欠款;

· 无论在境内外持有;由非居民发出的;

· 商业本票,商业票据,银行无担保债券,贷款,房屋按揭,等等;

· 定期存款,政府债券,等等

4.Interests in non-resident trusts 非居民信托利益

· 不包括海外附属公司中的非居民信托

· 如有追加投入,收到信托分配,从信托得到贷款,请申报T1141/T1142

5.Real property outside Canada 加拿大境外的物业

· 不包括私人用物业(主要是用于个人家庭生活居住)

· 不包括生意用途的物业(企业的厂房,仓库,办公楼等)

· 出租的物业需要申报

6.Other property outside Canada 其它加拿大境外资产

· 在海外持有加拿大公司股份

· 通过合伙人制持有海外资产,但合伙人架构不需申报T1135的情况,个人申报

· 符合特别海外资产定义的人寿保险

· 海外持有的稀有金属或金银币

· 同上述海外资产相关的商品或期货合约,期权或金融衍生品

· 任何可导致对海外资产拥有,取得,占有利益的权利

7.Property held in an account with a Canadianregistered securities dealer or a Canadian trust company

· 由加拿大证券公司或信托公司持有的资产

· 由一家上述公司持有的所有资产应按国名汇总;

· 以可按不同的帐户在国名下汇总;

· 一年期间的最高市值可采用最高的月末市值;

D 哪些海外资产不需要申报?

海外个人使用的资产就不需要申报,例如自住房,汽车,珠宝,绘画等一些藏品是不需要申报的。

所有注册退休储蓄计划(RRSP)和免税储蓄账户(TFSA)中持有的任何海外投资。

如果您在海外资产的申报中有任何问题,欢迎联系我们。我们将带给您最专业,最全面的税务咨询,

请致电:289-597-1869

欢迎添加我们的微信客服号进行详细咨询:

信诚客服号 - aoetaxation

Recently, many friends hope that AOE will give you a detailed analysis of the issue of rental income. Today, AOE editor will give you a detailed analysis of house rental income.

What expenses can be deducted from taxes?

1. Bank fees and interest

· All loans directly used to purchase and repair rental houses (housing loans, line of credit), the interest part can be deducted.

· Bank fees, mortgage insurance, lawyer fees, etc. when applying for loans are deducted according to 20% of the total amount for 5 years.

2. Insurance

· The housing insurance of the rental house, the landlord insurance (LandlordInsurance), can only be deducted from the premium (premium) of the current year.

3. Advertising expenses

· The expenses of the landlord placing rental advertisements in various media can be deducted.

4. Property management fee

· Condo management fee (Condo Fee)

· Ask the property management company or real estate agent to manage it.

· The trusteeship fee for helping to find tenants can be deducted in one lump sum in the current year.

· Landlords with many houses hire full-time workers to manage the rental houses. The wages paid to the workers, CPP, EI, insurance and other expenses can also be deducted.

5. Office supplies

· Small office supplies consumed for handling rental business, such as pens, pencils, printing paper, staples, and stamps when signing documents (Lease) can be used to deduct rental income.

6. Property Tax (Property Tax)

· Only the property tax during the rental period can be deducted. Here it is the property tax, not the land transfer tax (Land transfer tax). The land transfer tax is the cost of buying a house.

7. House Maintenance

· The labor and material costs incurred in repairing the house, clearing the drains, changing the stove, changing the toilet, etc. can be deducted.

· If the landlord does the repairs himself, only the material cost can be deducted, and the landlord’s own labor cannot be counted.

8. Professional fees

· The attorney fees incurred for asking a lawyer to write a lease or collect rent, as well as the fees for asking an accountant to keep accounts, assist in audits, and report rental property taxes are all professional fees and can be deducted from the rent. The attorney fees for buying and selling a house are the cost of selling the house and cannot be deducted from the rent.

9. Utility fees(Utility)

10. Vehicle fees

· For landlords who have only one rental house: The landlord must do the maintenance work of the rental house himself, and the vehicle fees are incurred for transporting maintenance tools and materials. For landlords who have only one rental house, the vehicle fees incurred for collecting rent cannot be deducted.

· If you have more than two rental houses: In addition to the above-mentioned deductions, you can also add the landlord's car expenses for collecting rent and the landlord's travel expenses for supervising (the rental house and the landlord's own home may not be in the same area).

· Note: The amount of vehicle expenses should be as reasonable and conservative as possible. There must be a driving record (automobile log) to record the date, purpose, and mileage of each trip.

11.Other expenses

Can all expenses be deducted from taxes?

If the investment property is fully rented out, all the above expenses can be deducted 100% of the income. If you only rent out part of your own house, you can only deduct part of all the expenses. After all, no one wants to be identified as an investment property by the tax bureau when selling the house.

What should I do if I lose money by renting it out to my family?

There is another question that our accountants are often asked: A rents out the house to his children, but the rent is very low, so the house is losing money every year. A wants to use the loss of the house to deduct his T4 income.

According to the regulations of the tax bureau, if the loss of renting out to relatives at a price lower than the market price cannot be used to deduct other income, these losses can only be borne by yourself.

If you have any questions about rental income, please contact us. We will provide you with the most professional and comprehensive tax consultation,

Please call: 289-597-1869 or

Welcome to add our WeChat customer service number for detailed consultation:

AOE Taxation customer service number - aoetaxation

最近很多朋友希望AOE再给大家详细的解析一下房租收入的问题,今天AOE小编就给大家来一个详细解析房屋出租收入。

哪些费用可以抵税?

1. 银行费用和利息

· 所有直接用于购买和修缮出租房的借款(房屋贷款,lineof credit),利息部分可以抵扣。

· 申请贷款时的银行费用,房贷保险,律师费等按照总金额的20%分5年抵扣。

2. 保险

· 出租房的房屋保险,房东保险(LandlordInsurance),只能抵扣当年的保费(premium)。

3. 广告费

· 房东招租在各种媒体上登租房广告的费用可以抵扣。

4. 物业管理费

· Condo的管理费(Condo Fee)

· 请物业管理公司或地产经纪代管。

· 帮助寻找租客的托管费都可以在当年一次性抵扣。

· 房子多的房东请全职工人管理出租房,付给工人的工资、CPP、EI、保险等费用也可以抵。

5. 办公用品

· 为操办租房业务而消耗的小件办公用品,如签文件(Lease)时的钢笔、铅笔、打印纸、订书钉,邮票都可以用来抵减房租收入。

6. 地税 (Property Tax)

· 只能抵扣出租时间的地税,这里是地税,不是土地转让税(Land transfer tax), 土地转让税是买房成本。

7. 房屋维修

· 修房子,通渠,换炉头,换马桶等而发生的人工费和材料费可以抵。

· 房东自己动手维修,只可抵材料费,房东自己的人工不能算。

8. 专业人士费用

· 请律师撰写租约或者追讨房租而发生的律师费,以及请会计师记账,协助审计,报出租房税的费用都属于专业人士费,可以抵减房租。买卖房子的律师费是卖房成本,不能抵减房租。

9. 水电气费 (Utility)

10.车辆费

· 只有一套出租房的:房东要亲自动手做出租房的维护工作,车费是为了运载维修工具和材料而发生的。只有一套出租房的房东,为收租而产生的车费不能抵扣。

· 有两套以上出租房的:除了可以抵扣上面提到的,还可以加上房东为收租产生的车费以及房东去监工而产生的差旅费(出租房和房东自家可以不在同一区域)。

· 注意:车辆费的金额要尽可能合理、保守。必须有行车记录(automobile log),记录每次出行的日期,目的, 和公里数。

11.其他费用

全部费用都可以抵税吗?

如果是投资房全部出租出去,以上所有费用100%可以抵扣收入。如果您只是把自家的一部分出租出去,那您只能抵扣所有费用的一部分,毕竟谁也不想在卖房子的时候被税局认定成投资房来交税的。

给家人出租的亏损怎么办?

还有一个问题我们的会计师们经常被问到:A把房屋出租给了自己的孩子住,但是房租收的非常低,这样房子出租每年都在亏损。A想用房子的亏损在抵扣自己的T4收入。

根据税局的规定,如果低于市场价出租给亲属的亏损是不能来抵扣其他收入,这些亏损只能自己承担。

如果您在房租收入中有任何问题,欢迎联系我们。我们将带给您最专业,最全面的税务咨询,

请致电:289-597-1869或

欢迎添加我们的微信客服号进行详细咨询:

信诚客服号 - aoetaxation

Let's continue with Lao Yang's story from last time(For Lao Yang's story on selling a house, please click on this link:AOE Taxation | Tax issues on house sales (2/2) ). Last time, we talked about how Lao Yang transferred his investment property to Xiao Yang for 1 yuan, but he did not save tax and was taxed twice. It seems that VAT is inevitable. Is there any way to pay less or delay tax?

Canadian tax law-Income Tax Act s.40(1)(a)(iii) stipulates that it is possible to delay the realization of investment income to achieve the purpose of paying investment income tax in installments-Capital Gain Reserve.

What does this mean?

1. The income must be investment income-Capital Gain. This clause does not apply to the business of selling and buying houses;

2. The house price cannot be paid in full at one time.

How long can it be postponed? How to operate it?

The tax law stipulates that ordinary residential properties can be amortized for up to 5 years, and farms or fisheries can be amortized for up to 10 years.

Last time, it was calculated that if Lao Yang's house was sold at the market price, Lao Yang would have to pay $96,000 in personal tax. Using capital gain reserve, the proceeds from the sale of the house can be amortized over 5 years, and 20% of the house price can be collected each year. In 2019, the year of the sale, Lao Yang only needs to declare 20% of the increase in value, that is, 500,000*20% = 100,000, and the remaining 400,000 will be kept for the next year. In this way, Lao Yang's taxable increase in value in 2019 is only 100,000*50% = 50,000, and he only needs to pay $8,700 in tax.

In the second year, the same 20% is reported, and 100,000 is added to the taxable income. The remaining 300,000 (60% of the appreciation) is retained in the next year;

In the third year, the 20% is still reported, and 100,000 is added to the taxable income. The remaining 200,000 (40% of the appreciation) is retained in the next year;

In the fourth year, the 20% is still reported, 100,000 is added to the taxable income, and the remaining 100,000 (20% of the appreciation) is retained in the next year;

In the last year of the fifth year, 100,000 is added to the taxable income, and the Capital gain reserve is used up in this year.

You see, with the same 500,000 appreciation, using the Capital gain reserve, Lao Yang paid a total of $8,700 *5 = $43,500 in taxes in five years. Compared with the normal house transfer, Lao Yang paid $96,000 in taxes, and the Capital Gains Reserve helped Lao Yang save $50,000 in taxes.

Special reminder

1. Transfers between family members must be sold at market prices.

2. The transferee must issue an installment payment contract to the seller, stating that the amount owed will be paid off in 5 years, with 20% paid each year. It is best to have the contract notarized and signed by a lawyer.

3. T2017 is required to declare Capital gains reserve.

Capital gain reserves are not only applicable to real estate sales, but also to company equity transfers. Please contact your accountant for specific circumstances.

For tax services, please look for CPA

In this special period, you only need to calmly protect the physical and mental health of yourself and your family, and the remaining tax issues will be completed by our AOE CPA team.

Let's work together to get through this difficult time.

If you have any questions about taxation, please contact us. We will provide you with the most professional and comprehensive taxation advice.

Please call: 289-597-1869 or

Welcome to add our WeChat customer service number for detailed consultation:

AOE Taxation customer service number - aoetaxation

咱们接着上次的老杨的故事继续说(老杨卖房的故事请点击连接:信诚税务|房屋出售税务问题 (2/2))。上次说到,老杨以1元钱的价格转让他名下的投资房给小杨,不但没有省税,反而被重复征税。看来增值税是免不了的,有什么方法可以少交或者迟交税呢?

加拿大税法-Income Tax Act s.40(1)(a)(iii)中规定,可以采用延迟实现投资收益来达到分期缴纳投资收益税的目的-Capital Gain Reserve。

这是什么意思呢?

1.收益必须是投资收益-Capital Gain,经营房屋买卖生意不适用这个条款;

2.房款不能一次付清。

可以延期多长时间呢?如何操作呢?

税法规定,普通住宅最高可以平摊5年,农场或渔场最高可以平摊10年。

上次算出老杨的房屋以市场价转手,老杨要交$96,000的个人税。利用Capital gain reserve,卖房收益平摊到5年, 每年收房款的20%,那么在2019转手这一年老杨只需申报20%的增值,也就是50万*20% =10万,剩余的40万留到下一年。这样,2019年老杨的应税增值只有10万*50% = 5万,只要付 $8700的税就可以了。

到了第二年同样报20%,10万加到应税收入里。其余30万(60%的增值)留到下一年;

到了第三年照旧报20%,10万加到应税收入里。其余20万(40%的增值)留到下一年;

到了第四年还是报20%,10万加到应税收入里,其余10万(20%的增值)留到下一年;

到了第五年最后一年,10万加到应税收入里,Capital gain reserve 到这一年用光。

你看,同样的50万增值,利用Capital gain reserve,老杨五年下来一共交$8,700 *5 = $43,500 的税。相比正常的房屋转让,老杨交 $96,000的税,Capital Gains Reserve 帮老杨省$50,000的税。

特别提醒

1.家人之间的转让一定要按市场价出售。

2.受让方要出具分期付款的合同给卖出方,说明所欠金额分5年付清,每年付20%,合同最好让律师公证签字。

3.申报Capital gains reserve需要提交T2017。

Capital gain reserves不光适用于房产买卖,同时也适用于公司股权转让。具体的情况请与您的会计师联系。

税务服务,请认准CPA

在这个特殊的时期,您只需要从容安心地保护好自己和家人的身心健康,剩下的税务问题由我们AOE信诚的CPA团队来完成。

让我们一起加油渡过难关。

如果您在税务中有任何问题,欢迎联系我们。我们将带给您最专业,最全面的税务咨询,

请致电:289-597-1869 或

欢迎添加我们的微信客服号进行详细咨询:

信诚客服号 - aoetaxation

Let’s continue with the issue of selling a house for personal use or rental.

Last time, we talked about living in the house first and renting it out later. We can use the 45(2) election to extend the years of personal use (up to 4 years). This issue mainly discusses the tax operation of renting out first and then living in the house.

The 45(3) election needs to be submitted when filing the tax return in the year of selling the house. It changes the house from rental to personal use, and is used to extend the years of personal use (up to 4 years). The purpose of using the investment-free income of the personal use house to save taxes/exempt taxes can be achieved.

Let’s take an example:

Mr. Wang bought a house worth 400,000 yuan for rental in 2011 and reported the rental income every year. In 2015, Mr. Wang took back the house for personal use. The market value of the house in 2015 was 800,000 yuan, and it was sold for 1.2 million yuan in 2019.

So, Lao Wang filed taxes like this in 2019:

Rental: 2011 to 2015, 4 years

Owned: 2015 to 2019, 4 years

Holding: 2011 to 2019, 8 years

Total value-added: 120-40=800,000

Owned housing tax-free: (4+1)/8*80=500,000

Rental housing is not tax-free: 800,000-500=300,000

Taxable value-added: 30*50%=150,000

Mr. Wang’s income in 2019 was $70,000, and he had to pay $13,684 in taxes. Adding the $150,000 from the sale of the house, his total taxable income was $220,000, and he had to pay $79,844 in taxes. Mr. Wang would have to pay an additional $66,160 in taxes for the increased value from the sale of the house.

If Mr. Wang did not do tax planning, he would have to pay an additional $66,160 in taxes. However, Mr. Wang had a reliable accountant who made a 45 (3) election when filing his 2019 tax return, stating that the deemed disposition from renting out the house to living in it did not exist, and designated the four years from 2011 to 2015 as self-occupied housing. In this way, the house was owned from 2011 to 2019, and the $800,000 in increased value was completely tax-free.

Let me remind you again that a couple can only designate one property as their own residence each year. It is recommended that you consult your accountant on how to report your property investment income to achieve tax optimization.

Next, let's talk about the tax issues of property transfer.

Mr. Yang is going to transfer his investment house to his daughter, Xiao Yang. In order to pay less investment income and land transfer tax, Mr. Yang wants to sell the house to Xiao Yang for $1. Xiao Yang thinks it's better to listen to the advice of tax experts, so the father and daughter discuss and come to Accounting Firm. The certified public accountant of Accounting Firm helped Mr. Yang and Xiao Yang to calculate the accounts.

1. Tax treatment of Mr. Yang's sale of investment houseAccording to CRA regulations, if you transfer or sell a house to anyone other than your spouse, the selling price of the house should be the market price rather than a price below the market price. That is to say, although the contract states that the house was sold to Xiao Yang for $1, CRA still believes that the house was sold at the market price, which is $1 million, and Lao Yang bought it for $500,000. That is to say, half of the investment income of $500,000, $250,000, is included in Lao Yang's income for the year. If Lao Yang has no other income, Lao Yang needs to pay $96,911 in tax. 2. Tax treatment of Xiao Yang's investment house

Xiao Yang spent $1 to buy the investment house, and the cost of the investment house is $1. If Xiao Yang sells the house at the market price of $1 million, then Xiao Yang's investment income is $999,999, half of which is included in Xiao Yang's income for the year. If Xiao Yang has no other income, Xiao Yang needs to pay $230,735 in tax.

That is to say, the income from this investment property is 500,000 yuan, and they will eventually pay $327,646 in taxes for this $1 transaction, with a marginal tax rate of 65.53%.

Lao Yang and Xiao Yang's $1 transaction not only did not save taxes, but also paid taxes repeatedly. Now, Lao Yang and Xiao Yang are depressed.

Is there any way to help the father and daughter? We will explain to you next week - installment declaration of investment income.

If you have any questions about the tax on house sales, please contact us. We will provide you with the most professional and comprehensive tax consultation,

Please call: 289-597-1869 or

Welcome to add our WeChat customer service number for detailed consultation:

AOE Taxation customer service number - aoetaxation

咱们接着上次的卖自住/出租房的问题继续讲。

上次说的是先自住,后出租可以用45(2)election 延长自住年份(最多延4年),这期主要讨论先出租再自住的税务操作–45(3)。

45(3) election需要在卖房那年报税时提交,把从出租变成自住,用来延长自住年份(最多延4年),利用自住房免投资收益来达到省税/免税的目的。

咱们举例说明:

老王于2011年买了一处40万的出租,每年报房租收入。2015年,老王把房子收回自住,2015年房子的市值是80万,2019年以120万卖出。

所以,2019年老王这样报税:

出租:2011到2015,4年

自住:2015到2019,4年

持有:2011到2019,8年

总增值:120-40=80万

自住房免税:(4+1)/8*80=50万

出租房不免税:80-50=30万

应税增值:30*50%=15万

老王2019年的收入是7万,需要交税$13,684;再加卖房的15万,一共22万的应税收入,需要交$79,844的税款,老王就要为卖房的增值收益多交$66,160的税款。

如果老王不做税务规划,他就要多交$66,160的税。但是,老王有个靠谱的会计师,在2019年报税时做了一份45(3)election,提出房子从出租到自住产生的deemed disposition不存在,指定从2011到2015出租的这4年为自住房,这样从2011到2019年都是自住房,80万的增值全部免税。

再提醒一次,夫妻每年只能指定一处房产为自住房。建议大家咨询自己的会计,怎么报房产投资收益可以达成税务最优化。

下面再来给大家谈谈房产转让的税务问题。

老杨准备把他的投资房转给他的女儿-小杨,为了少交投资收益和土地转让税,老杨想以$1元钱的价格把房子卖给小杨,小杨觉得还是听听税务专家的建议,于是父女商量来到了信诚会计事务所。信诚会计事务所的注册会计师帮老杨和小杨算了一笔帐。

1.老杨卖投资房的税务处理按照CRA 的规定,如果你把房子转让或者出售给配偶以外的任何人,这个房子的卖价应该是市价而不是低于市价的价格。也就是说,虽然,合同上写的是$1元 的价格卖给了小杨,CRA 还是认为这个房子是按照市场价出售的,市价是100万,老杨的买价是50万,也就是说,投资收益50万的一半25万计入老杨当年的收入,如果老杨没有其他收入,老杨需要交$96,911的税。 2.小杨的投资房的税务处理

小杨花了$1元钱买了投资房,这个投资房的成本是$1元钱,如果小杨以市场价格100万卖了这个房子,那么,小杨的投资收益就是$999,999,一半计入小杨当年的收入,如果小杨没有其他收入,小杨需要交$230,735的税。

也就是说,这个投资房的收益是50万,他们俩最后要为这个$1元钱的交易付 $327,646的税,边际税率高达65.53%。

老杨和小杨的$1元钱交易,不但没有省税还重复交税,这下,老杨和小杨郁闷了。

有什么办法可以帮助到父女俩呢?我们下周将会给大家讲解—投资收益分期申报。

如果您在房屋出售税务中有任何问题,欢迎联系我们。我们将带给您最专业,最全面的税务咨询,

请致电:289-597-1869或

欢迎添加我们的微信客服号进行详细咨询:

信诚客服号 - aoetaxation

More and more customers are asking about tax issues after selling their houses. To sum up, there are mainly the following issues.

1. Selling a self-occupied house

On October 3, 2016, the Canadian government announced that the sale of a self-occupied house needs to be reported to the tax bureau. Although self-occupied houses do not need to pay investment income, the following information needs to be reported when filing taxes.

a. Designated house to be sold as a self-occupied house

b. Year of purchase

c. Price of the house

2. Selling an investment house

When selling an investment house, you need to calculate the investment income. Half of the investment income is included in the total income of the year and needs to be taxed. How to calculate investment income?

Investment income = selling price - adjusted cost - costs incurred when selling a house

Let's explain in detail what adjustment costs and selling costs are

a. Adjusted cost

Adjusted cost is the purchase price plus the cost of buying a house, such as agent commissions and attorney fees. If there are capital expenditures during the holding period of the house, they should also be included in the adjustment cost. However, current expenses such as maintenance costs cannot be included in the adjustment cost. Which expenses are capital expenditures and which expenses are current expenses are different for each house. For details, you can consult our accountants.

b. All expenses incurred when selling a house

The costs of selling a house include agent commissions, attorney fees, advertising fees, transfer taxes/fees, etc.

3. Selling a self-occupied/rental house

The question is, if a property was previously occupied and later rented out; or previously rented out and later occupied; how should the investment income be reported?

Let's take an example:

Lao Wang bought a 400,000 yuan self-occupied house in 2011. In 2015, Lao Wang changed to a larger house and rented out the smaller house, reporting the rental income every year. In 2019, he sold it for 1.2 million yuan. Therefore, Mr. Wang filed taxes like this in 2019:

Owned: 2011 to 2015, 4 years

Rented: 2015 to 2019, 4 years

Holding: 2011 to 2019, 8 years

Total value-added: 120-40=800,000

Owned housing tax-free: (4+1)/8*80=500,000

Rented housing is not tax-free: 800-50=300,000

Taxable value-added: 30*50%=150,000

Mr. Wang's income in 2019 was 70,000, and he needed to pay $13,684 in taxes; plus the 150,000 from the sale of the house, a total of 220,000 taxable income, and a tax of $79,844. Mr. Wang had to pay an additional $66,160 in taxes for the value-added gains from the sale of the house.

If Mr. Wang did not do tax planning, he would have to pay an additional tax of $66,160. However, Mr. Wang has a reliable accountant who made a 45 (2) election when filing his 2015 tax return, extending the years of self-occupancy (up to 4 years), designating the 4 years from 2015 to 2019 as the self-occupancy period, and all the appreciation of $800,000 is tax-free.

A reminder once again, a couple can only designate one property as a self-occupation each year. It is recommended that you consult your accountant on how to report real estate investment income to achieve tax optimization.

We will continue to explain the tax issues of house sales next week (2/2)

If you have any questions about house sales taxes, please contact us. We will provide you with the most professional and comprehensive tax advice,

Please call: 289-597-1869 or

Welcome to add our WeChat customer service number for detailed consultation:

AOE Taxation customer service number - aoetaxation

越来越多的客户咨询房屋出售后的税务问题,总结一下,主要有以下几个问题。

1.卖自住房

在2016.10.03,加拿大政府宣布,出售自住房需要上报税局。虽然,自住房不需要交投资收益,但是, 在报税的时候,需要申报以下信息。

a.指定卖的房子是自住房

b.买房年份

c.房屋出售的价格

2.卖投资房

卖投资房,需要计算投资收益,投资收益的一半计入当年的总收入,需要交税。如何计算投资收益?

投资收益=卖价-调整后的成本-卖房时发生的费用

我们具体解释一下什么是调整成本和卖房费用

a.调整的成本

调整成本就是买价加买房的费用,比如代理的佣金,律师费。如果在房屋持有期间有资本支出,也应该包括在调整成本里。但是,当期费用像维护费用就不能包括在调整成本里。哪些费用是资本支出,哪些费用是当期费用,每个房的情况都不一样,具体的,大家可以咨询我们的会计师。

b.卖房时发生的所有费用

卖房的费用包括代理佣金,律师费,广告费,转让税/费等。

3.卖自住/出租房

问题来了,如果一处房产,以前是自住,后来转出租;或者以前是出租,后来转自住;应该怎么报投资收益?

咱们举例说明:

老王于2011年买了一处40万的自住,2015年,老王换了大房,小房出租,每年报房租收入,2019年以120万卖出。所以,2019年老王这样报税:

自住:2011到2015,4年

出租:2015到2019,4年

持有:2011到2019,8年

总增值:120-40=80万

自住房免税:(4+1)/8*80=50万

出租房不免税:80-50=30万

应税增值:30*50%=15万

老王2019年的收入是7万,需要交税$13,684; 再加卖房的15万,一共22万的应税收入,需要交$79,844的税款,老王就要为卖房的增值收益多交$66,160的税款。

如果老王不做税务规划,他就要多交$66,160的税。但是,老王有个靠谱的会计师,在2015年报税时做了一份45(2)election, 延长了自住年份(最多延4年),指定从2015到2019出租的4年为自住期,80万的增值全部免税。

再提醒一次,夫妻每年只能指定一处房产为自住房。建议大家咨询自己的会计,怎么报房产投资收益可以达成税务最优化。

我们下周将会继续给大家讲解房屋出售税务问题 (2/2)

如果您在房屋出售税务中有任何问题,欢迎联系我们。我们将带给您最专业,最全面的税务咨询,

请致电:289-597-1869或

欢迎添加我们的微信客服号进行详细咨询:

信诚客服号 - aoetaxation

In the previous article, AOE analyzed the enterprise welfare subsidies during the epidemic period issued by the government (last review link: AOE Taxation | Analysis of Government Benefits During the Epidemic - Enterprise Edition), today we will update you based on the latest policy:

1. What is the temporary wage subsidy for employers?

The temporary wage subsidy for employers is a three-month measure that allows eligible employers to pay less wage deductions to the Canada Revenue Agency (CRA).

2. Which employers are eligible?

If you meet the following conditions:

3. How much is the subsidy?

The subsidy is equal to 10% of your compensation from March 18, 2020 to June 20, 2020, up to a maximum of $1,375 per employee and $25,000 per employer.

The associated CCPC will not share the $25,000 maximum subsidy per employer.

For example, if you have 5 employees, the maximum subsidy you can receive is $6,875 ($1,375 x 5 employees), even though the maximum limit per employer is $25,000.

4. How is the subsidy calculated?

The subsidy must be calculated manually.

For example, if you have 5 employees with a monthly salary of $4,100 and a total monthly salary of $20,500, the subsidy is 10% of $20,500 or $2,050.

5. How do I get the subsidy?

After calculating the subsidy, you can reduce the amount of income tax you have to pay by the subsidy.

Important: You cannot reduce your Canada Pension Plan contributions and unemployment insurance contributions.

For example, if you have a subsidy of $2,050, you can reduce your income tax by $2,050. You can continue to reduce your income tax by up to $25,000 for all remuneration paid before June 20, 2020.

6. When can you start reducing your payments?

You can start reducing your income tax payments in the first payment period, which includes remuneration paid between March 18, 2020 and June 20, 2020.

For example, if your company makes quarterly payments, the payment to the CRA on April 15, 2020 can include the subsidy.

7. What if the subsidy exceeds the tax you owe?

If the income tax you owe is not enough to offset the subsidy amount for a particular period, the balance can be used to reduce the income tax you owe in the future. This includes reducing remittances that may extend beyond the wage subsidy application period (after June 20, 2020).

For example: If you calculated a subsidy of $2,050 for wages paid between March 18, 2020 and June 20, 2020, but only deducted income tax for $1,050 from employees, you can reduce your future income tax remittance by $1,000, even if the remittance is for wages paid after June 20, 2020.

8. Does the subsidy affect employee deductions?

No. You will continue to deduct income tax, Canada Pension Plan contributions, and unemployment insurance benefits from wages, bonuses, or other remuneration paid to employees, just as you currently do. The subsidy is calculated only when you remit those amounts to the CRA.

9. What if I don’t reduce my remittances during the year?

If you are an eligible employer but choose not to reduce your payroll remittances during the year, calculate the temporary wage subsidy for remuneration paid between March 18, 2020, and June 20, 2020. You can then ask for the subsidy to be paid to you at the end of the year, or transferred to your remittance account for the following year.

10. What documentation do I need?

You will need to keep information to support your subsidy calculation. This includes:

The CRA is currently updating reporting. More information on how to report this subsidy will be released soon.

11. Is the subsidy considered taxable income?

Yes. If you receive a subsidy, you must report the total amount to the CRA in the year you receive the subsidy.

12. What if my business is closed?

If you did not pay wages, bonuses or other remuneration to your employees between March 18, 2020 and June 20, 2020, you will not be able to receive a subsidy even if you are a qualified employer.

For tax services, please look for CPA

During this special period, you only need to calmly protect the physical and mental health of yourself and your family, and the rest of the tax issues will be completed by our AOE CPA team.

Let's work together to get through this difficult time.

If you have any questions about taxation, please contact us. We will provide you with the most professional and comprehensive taxation advice.

Please call: 289-597-1869 or

Welcome to add our WeChat customer service number for detailed consultation:

AOE Taxation customer service number - aoetaxation

上一篇文章AOE信诚给大家分析了一下政府颁布的疫情期间企业福利补贴(上期回顾连接:信诚税务|疫情期间 政府福利解析-企业篇),今天我们根据最新的政策来给大家Update一下:

1. 雇主的临时工资补贴是什么?

雇主临时工资补贴是一项为期三个月的措施,允许符合条件的雇主少交工资抵扣款给加拿大税务局(CRA)。

2. 哪些雇主符合资格?

如果您符合以下条件:

3. 补贴是多少?

补贴相当于您2020年3月18日至2020年6月20日期间薪酬的10%,每位雇员最高$1,375,每个雇主最高为$25,000。

相关联的CCPC将不会分担每个雇主$25,000的最高补贴。

例如,如果您有5名员工,您可以获得的最高补贴是$6,875($1,375 x 5 名员工),即使每个雇主的最高限额为$25,000。

4. 如何计算补贴?

补贴必须手动计算。

例如,如果您有5名员工的月薪为$4,100,月工资总额为$20,500,则补贴为10%的$20,500即$2,050。

5. 如何获得补贴?

计算补贴后,您可以按照补贴减少您需要交的所得税。

重要提示:您不能减少加拿大养老金计划供款和失业保险金的供款。

例如,如果您有$2,050的补贴,您在交所得税的时候,可以减少$2,050。对于2020年6月20日之前支付的所有报酬,您可以继续减少需交所得税,最高可达$25,000。

6. 何时可以开始减少交款?

您可以在第一个交款期内开始减少所得税的款项,其中包括2020年3月18日至2020年6月20日期间支付的薪酬。

例如,公司是季度交款,2020年4月15日给CRA的交款就可以包括这项补贴。

7. 如果补贴超过应交税款怎么办?

如果您需要交的所得税不足以抵消特定期间的补贴金额,余额可以用来减少将来需要交的所得税。这包括减少可能超出工资补贴申请期限的交款(2020年6月20日之后)。

例如:如果您计算了2020年3月18日至2020年6月20日期间支付的薪酬补贴 $2,050,但仅扣除了员工的$1,050的所得税,则可以将未来的所得税汇款减少$1,000,即使应交款是2020年6月20日以后支付的薪酬。

8. 补贴是否会影响员工的扣减?

不。您将继续从支付给员工的工资,奖金或其他报酬中扣除所得税,加拿大养老金计划缴款以及失业保险金,就像您目前这样做一样。补贴仅在您将这些金额汇入CRA时计算。

9. 如果我在年内不减少汇款怎么办?

如果您是符合条件的雇主,但选择年内不减少工资汇款,请计算2020年3月18日至2020年6月20日期间支付的薪酬临时工资补贴。然后,您可以要求在年底将补贴支付给您,或转入下一年的应交款账号。

10. 我需要证明材料?

您需要保留信息来支持您的补贴计算。这包括:

CRA目前正在更新报告。有关如何报告此补贴的更多信息将于近期发布。

11. 补贴是否被视为应纳税收入?

是的。如果您收到补贴,您必须在收到补贴的年份向CRA报告总金额。

12. 如果我的生意关闭了怎么办?

如果您在2020年3月18日至2020年6月20日期间未向员工支付工资,奖金或其他报酬,即使您是合格的雇主,您也无法获得补贴。

税务服务,请认准CPA

在这个特殊的时期,您只需要从容安心地保护好自己和家人的身心健康,剩下的税务问题由我们AOE信诚的CPA团队来完成。

让我们一起加油渡过难关。

如果您在税务中有任何问题,欢迎联系我们。我们将带给您最专业,最全面的税务咨询,

请致电:289-597-1869 或

欢迎添加我们的微信客服号进行详细咨询:

信诚客服号 - aoetaxation

The Government of Canada is taking immediate, significant and decisive action to support Canadian businesses facing financial distress as a result of the COVID-19 pandemic.

This article AOE will explain to you the support for businesses.

Helping businesses retain employees:

To help businesses facing revenue losses and prevent layoffs, the government is proposing to provide a threemonth temporary wage subsidy to eligible small employers. The subsidy will be equal to 10% of remuneration during that period, with a maximum subsidy of $1,375 per employee and a maximum subsidy of $25,000 per employer.

Employers benefiting from this measure will include companies eligible for small business relief as well as non-profit organizations and charities.

Flexible tax filings for businesses:

The Canada Revenue Agency will allow all businesses to defer until August 31, 2020 any income tax amounts that are due on or after today and before September 2020. No interest or penalties will accrue on these amounts during this period.

For the next four weeks, the Canada Revenue Agency will not contact any small and medium-sized (SME) businesses regarding GST/HST or income tax audits. For the vast majority of businesses, the Canada Revenue Agency will temporarily suspend audit interactions with taxpayers and representatives.

Ensuring access to business loans for businesses:

The Business Credit Availability Program (BCAP) will enable the Business Development Bank of Canada (BDC) and Export Development Canada (EDC) to provide more than $10 billion in additional support, primarily for SMEs. The BDC and EDC are working with private sector lenders to coordinate credit solutions for individual businesses, including in sectors such as oil and gas, air transport and tourism. Short-term credit to farmers and the agri-food sector will also be increased through Farm Credit Canada.

The Office of the Superintendent of Financial Institutions (OSFI) announced that it has reduced the domestic stability buffer by 1.25% of risk-weighted assets, effective immediately. The move will allow Canada's large banks to inject an additional $300 billion in lending into the economy.

This includes a reduction in interest rates to 0.75% as a proactive measure, given the negative shock to the Canadian economy caused by the COVID-19 pandemic and the recent sharp drop in oil prices.

Supporting financial market liquidity

On March 16, the government announced that it would launch the Insured Mortgage Purchase Program (IMPP). Under the program, the government will purchase up to $50 billion of secured mortgage pools through the Canada Mortgage and Housing Corporation (CMHC). This move will provide banks and mortgage lenders with long-term stable funding, help facilitate continued lending to Canadian consumers and businesses, and add liquidity to Canada's mortgage market. Details of the terms of the purchase operation will be provided to lenders by CMHC later this week.

The Bank also announced that, as a proactive measure, it stands ready to provide support to the Canada Mortgage Bond (CMB) market to enable this important funding market to continue to function normally. This will include secondary market purchases of CMBs as needed. Similar to the increase in Canadian government bond repurchases, this will support market liquidity and price discovery.

AOE reminds everyone to contact your accountant as soon as possible. If you have a tax refund, please file your tax return as soon as possible and get your tax refund as soon as possible.

For tax services, please look for CPA

During this special period, you only need to calmly protect the physical and mental health of yourself and your family, and the rest of the tax issues will be completed by our AOE CPA team.

Let's work together to get through this difficult time.

If you have any questions about taxation, please contact us. We will provide you with the most professional and comprehensive taxation advice.

Please call: 289-597-1869 or

Welcome to add our WeChat customer service number for detailed consultation:

AOE Taxation customer service number - aoetaxation

加拿大政府正在采取立即,重大和果断的行动,以支持因COVID-19大流行而面临财务困境的加拿大企业。

这篇文章AOE信诚来给大家解读一下对企业的扶持。

帮助企业留住员工:

为了帮助面临收入损失的企业并防止裁员,政府提议向符合条件的小雇主提供为期三个月的临时工资补贴。 补贴将等于该时期薪酬的10%,每位雇员最高补贴为1,375加币,每位雇主最高补贴为25,000加币。

受益于这项措施的雇主将包括有资格获得小型企业减免的公司以及非营利组织和慈善机构。

灵活的企业申报税:

加拿大税务局将允许所有企业将直到今天或之后以及2020年9月之前应缴纳的任何所得税金额推迟到2020年8月31日之前使用。在此期间,这些金额不会累积任何利息或罚款。

在接下来的四个星期内,加拿大税务局将不会与任何中小型(SME)企业因为GST / HST或所得税审计而取得联系。对于绝大多数企业,加拿大税务局将暂时中止与纳税人和代表的审计互动。

确保企业获得商业贷款:

商业信贷可用性计划(BCAP)将使加拿大商业发展银行(BDC)和加拿大出口发展局(EDC)提供超过100亿加元的额外支持,主要针对中小企业。BDC和EDC正在与私营部门贷方合作,以协调针对个体企业的信贷解决方案,包括在石油和天然气,航空运输和旅游业等领域。通过加拿大农业信贷,还将增加对农民和农业食品部门的短期信贷。

金融机构监管办公室(OSFI)宣布,将国内稳定缓冲措施降低了风险加权资产的1.25%,立即生效。此举将使加拿大的大型银行向经济体注入3000亿加币的额外贷款。

鉴于因COVID-19大流行和近期油价大幅下跌对加拿大经济造成的负面冲击,这包括将利率降低至0.75%作为积极措施。

支持金融市场流动性

政府于3月16日宣布,将启动保险抵押购买计划(IMPP)。根据该计划,政府将通过加拿大抵押与住房公司(CMHC)购买多达500亿加元的有抵押抵押贷款池。此举将为银行和抵押贷款机构提供长期稳定的资金,有助于促进对加拿大消费者和企业的持续贷款,并为加拿大抵押贷款市场增加流动性。购买操作条款的详细信息将在本周晚些时候由CMHC提供给贷方。

世行还宣布,作为一项积极措施,它随时准备为加拿大抵押债券(CMB)市场提供支持,以使这一重要的融资市场继续正常运转。根据需要,这将包括在二级市场上购买CMB。与加拿大政府债券回购的增加类似,这将支持市场流动性和价格发现。

AOE信诚提醒大家,请尽快与您的会计师联系,如果有退税的,请尽快报税,早日拿到退税。

税务服务,请认准CPA

在这个特殊的时期,您只需要从容安心地保护好自己和家人的身心健康,剩下的税务问题由我们AOE信诚的CPA团队来完成。

让我们一起加油渡过难关。

如果您在税务中有任何问题,欢迎联系我们。我们将带给您最专业,最全面的税务咨询,

请致电:289-597-1869 或

欢迎添加我们的微信客服号进行详细咨询:

信诚客服号 - aoetaxation

The government released the latest CERB application regulations earlier. Today, the editor of AOE Taxation Professional Corp. will sort it out for you:

Who can apply for the Canada Emergency Response Benefit?

This benefit is only available to individuals who have stopped working due to COVID-19 related reasons.

For example, if you are a student who worked last summer and plan to work this summer, you are not eligible for benefits.

Under what circumstances can I apply for the Canada Emergency Response Benefit?

The Canada Emergency Response Benefit is available to people who have stopped working or are eligible for EI regular employment insurance or sickness benefits for reasons related to COVID-19. Stopping work means (but is not limited to):

Voluntarily quit your job and cannot apply for the emergency benefit.

If I am in quarantine or sick due to COVID-19, do I need a medical certificate to get the Canada Emergency Response Benefit?

No.

You can just apply online.

Do I need to be laid off to get the Canada Emergency Response Benefit?

No.

Employees of a company can receive company benefits. If you stop working due to COVID-19 and have no wage income for at least 14 consecutive days in the first four weeks, and expect to have no wage/self-employment income in the subsequent period.

If you are eligible for EI regular employment insurance or sickness benefits, you can also apply for the Canada Emergency Response Benefit.

Where can I apply for the Canada Emergency Response Benefit?

The application website will be launched on April 6, 2020, and applicants can apply for the benefit retroactively to March 15, 2020.

Until the website is launched, individuals who are not working and eligible for EI can continue to apply for unemployment insurance.

How much can I get through the Canada Emergency Response Benefit?

The benefit amount is $2,000, paid every four weeks. This is equivalent to $500 per week. Benefits are paid for up to 16 weeks.

This is a taxable benefit and you need to report the benefit as income when you file your income taxes for the 2020 tax year.

Can I receive other income while receiving the Canada Emergency Response Benefit?

No.

You must have stopped working due to COVID-19 and had no income for at least 14 consecutive days in the first four weeks, including paid leave income, self-employment income, or receiving any employment insurance benefits, and for subsequent dates, you expect to have no wage/self-employment income.

If you are eligible for EI regular employment insurance or sickness benefits, you can also apply for the Canada Emergency Response Benefit.

Can you get the Canada Emergency Response Benefit if you are not a citizen or permanent resident?

You must live in Canada and have a valid Social Insurance Number (SIN).

Workers who are not Canadian citizens or permanent residents (including temporary foreign workers and international students) may be eligible for the Canada Emergency Response Benefit if they meet other eligibility requirements.

Does the minimum required income of $5,000 have to be earned in Canada?

No.

The income does not have to be earned in Canada, but you do need to live in Canada.

When and how do I get the Canada Emergency Response Benefit? Is there a waiting period?

You will receive your benefit within 10 days of submitting your application, with no waiting period.

Payments will be made by direct deposit or cheque. Your payment will be backdated to the date you became eligible.

Do I need to provide any documents when applying for the Canada Emergency Response Benefit?

You will need to provide your personal contact information, your Social Insurance Number (SIN), and confirm that you meet the eligibility requirements.

The CRA may need documents from you in the future to confirm your eligibility.

If I already receive EI regular benefits, do I need to reapply for the Canada Emergency Response Benefit?

No.

If you already receive EI regular benefits, you will continue to receive those benefits until your benefit period ends.

If your EI started before March 15, 2020, and your EI ended before October 3, 2020, you can apply for the Canada Emergency Response Benefit if you meet the eligibility requirements for the emergency benefit.

You cannot receive EI and the Canada Emergency Response Benefit during the same period.

I have submitted an application for EI benefits but it has not been processed yet, do I need to reapply for the Canada Emergency Response Benefit?

No.

If you were eligible for EI benefits before March 15, your claim will be processed under EI.

If you became eligible for EI benefits after March 15, your claim will automatically be transferred to the Canada Emergency Response Benefit.

For tax services, please look for CPA

During this special period, you only need to calmly protect the physical and mental health of yourself and your family, and the rest of the tax issues will be completed by our AOE CPA team.

Let's work together to get through this difficult time.

If you have any questions about taxation, please contact us. We will provide you with the most professional and comprehensive taxation advice.

Please call: 289-597-1869 or

Welcome to add our WeChat customer service number for detailed consultation:

AOE Taxation customer service number - aoetaxation

政府于早前发布了最新的CERB的申请条例。今天信诚会计事务所(AOE Taxation Professional Corp.)的小编,来给大家整理一下:

谁可以申请加拿大紧急福利?

该福利仅适用于因COVID-19相关原因而停止工作的个人。

例如,如果你是学生,去年夏天有工作,并计划今年夏天工作,你没有资格享受福利。

在什么情况下我可以申请加拿大紧急福利?

加拿大紧急福利是提供给那些因COVID-19相关原因停止工作或有资格领取EI定期就业保险或疾病津贴的人。停止工作的意思包括(但不限于此):

自愿辞职,不能申请紧急福利。

如果我在COVID-19的隔离中或生病,是否需要医疗证明才能获得加拿大紧急福利?

不需要。

你只要网上申请就可以。

我需要被解雇才能获得加拿大紧急福利吗?

不需要。

公司的员工可以领取公司福利金。如果你因COVID-19而停止工作,并且在最初的四周内至少连续14天没有工资收入,并且预计在后续期间依旧没有工资/自雇收入。

如果你有资格享受EI定期就业保险或疾病津贴,你也可以申请加拿大紧急福利。

我在哪里可以申请加拿大紧急福利?

申请网站将于2020年4月6日开通,申请人可追溯至2020年3月15日申请该福利。

在网站开通前,没有工作且有资格参加EI就业保险的个人可以继续申请失业保险。

通过加拿大紧急福利可以获得多少?

福利金额为$2,000,每四周付一次。这相当于每周500元。最多可支付16 周的福利。

这是纳税福利,当你提交2020税务年度的所得税时,你需要将福利报告为收入。

在领取加拿大紧急福利时,我是否可以获得其他收入?

不可以。

你必须因COVID-19而停止工作,并且在最初的四周内至少连续14天没有收入,这包括带薪休假收入、自雇职业收入或领取任何就业保险福利,并且对于后续日期,你预计依旧没有工资/自雇收入。

如果你有资格享受EI定期就业保险或疾病津贴,你也可以申请加拿大紧急福利。

如果你不是公民或永久居民,你能否获得加拿大紧急福利?

你必须居住在加拿大并拥有有效的社会保险号(SIN)。

非加拿大公民或永久居民的工人(包括临时外国工人和国际学生)如果符合其他资格要求,可能有资格领取加拿大紧急福利。

最低要求收入$5,000是否一定是在加拿大赚取的收入?

不。

收入不必在加拿大赚取,但你需要居住在加拿大。

我何时以及如何获得加拿大紧急福利?有等待期吗?

提交申请后的10天内,你会收到福利,没有等待期。

付款将通过直接存款或支票支付。你的付款将追溯至你符合资格的日期。

申请加拿大紧急福利时,是否需要提供任何文件?

你需要提供你的个人联系信息、社会保险号(SIN),并确认你符合资格要求。

税局将来可能需要你提供相关文件,以确认你是否符合申请资格。

如果我已经领取了EI就业保险定期福利,我需要重新申请加拿大应急福利吗?

不需要。

如果你已经领取了EI就业保险定期福利,你将继续领取这些福利,直到你的福利期结束。

如果你的EI在2020年3月15日之前开始,并且EI在2020年10月3日之前结束,如果你符合申请紧急福利的资格要求,你可以申请加拿大紧急福利。

你不可以在同一期间同时获得EI就业保险福利和加拿大紧急福利。

我已经提交了EI福利申请,但是尚未处理,我需要重新申请加拿大紧急福利吗?

不需要。

如果你在3月15日之前有资格享受EI福利,将根据EI进行处理。

如果你于3月15日以后有资格享受EI福利,你的福利将自动转移到加拿大紧急福利部门。

如果我领取的EI高于$500/周,我能申请到更高的补助吗?

不可以。

当你申请加拿大紧急福利时,你每周将收到$500的福利补助。无论你获得哪种补助,每周最高福利为$500。

但是,在你停止领取加拿大紧急福利后,你依然有资格领取EI,你收到CERB的期间不会影响你的EI福利。

如果我的EI少于$500/周,我能否申请$500/周的补助?

可以。

当你申请加拿大紧急福利时,你每周将收到$500的福利补助。无论你获得哪种补助,每周最高补助为$500。

如果我在3月15日之前就失去了工作,但在3月15日之后申请EI,我可以获得哪些福利?

如果你在3月15日之前有资格享受EI,你的福利将按照EI进行处理。

如果我享受,如产假/育儿假的特殊EI福利,我是否还有资格申请加拿大紧急响应福利?

如果产假/育儿假结束之后因为COVID-19相关原因还是无法正常回到工作岗位,你可能有资格申请加拿大紧急福利。

不管您是需要申请EI,CERB还是企业福利,专业负责的会计事务所最值得您的信赖。

最后提醒大家请大家不信谣,不传谣。没事不出门,避免一切出国旅行。有家人、朋友还在海外的,请尽快催促他们回国。购买生活必须品时不要哄抢。大家一同携手,我们必定能够战胜新型冠状病毒。

税务服务,请认准CPA

在这个特殊的时期,您只需要从容安心地保护好自己和家人的身心健康,剩下的税务问题由我们AOE信诚的CPA团队来完成。

让我们一起加油渡过难关。

如果您在税务中有任何问题,欢迎联系我们。我们将带给您最专业,最全面的税务咨询,

请致电:289-597-1869 或

欢迎添加我们的微信客服号进行详细咨询:

信诚客服号 - aoetaxation

From the beginning of 2020 to now, the editor of AOE Taxation Professional Corp. has witnessed countless historical moments with everyone. We have all mourned the fall of superstars. We have all witnessed the oil like water. We have all experienced the ravages of the epidemic. … …

Most importantly, we have all felt the power of unity and love. Since the beginning of the epidemic, the government has gradually introduced a lot of epidemic benefits to help everyone get through the difficulties. Today, the editor of AOE has compiled a Q&A about epidemic benefits for everyone, hoping to help everyone who needs help. *The editor will change the key words to blue today to pay tribute to the front-line medical staff. Thank them for all they have given.

1. I had no work income in 2019, but my rental income and investment income exceeded $5,000. Can I apply for emergency benefits?

No. The government stipulates that the sources of income are: salary income, self-employment income, and maternity leave EI income

2. Can EI and emergency benefits be enjoyed together?

No.

3. The epidemic is so serious, so I took the initiative to resign from the company. Can I apply for emergency benefits?

No.

4. I went back to China for the Chinese New Year and now I can't enter Canada. Can I apply for emergency benefits?

No. After you come back, if you still meet the requirements, you can apply.

5. My company has resumed work, but my children still can't go to school. I need to take care of them at home. I can't resume work. Can I continue to apply for emergency benefits?

Yes. As long as you make sure that your monthly income from work is less than $1,000 while you are at home taking care of your children.

6. My own company pays itself a salary. Now I stop paying myself a salary, and I have no income every month. Can I apply for emergency benefits?

Yes. But we do not recommend that you do so, because the government's emergency benefits are for those who really need help.

7. I have received my maternity leave EI, but because of the epidemic I cannot return to work. Can I apply for emergency benefits?

Yes.

8. After receiving my maternity leave EI, I applied for a student loan, but now I am at home taking care of my children who cannot go to school. Can I apply for emergency benefits?

Yes.

9. The $5,000 income requirement for applying for emergency benefits must be Canadian income?

Not necessarily. It can be overseas work income, but it must be reported when filing taxes.

10. I have no overseas work income in Canada, nor Canadian work income. But I have overseas assets, and I declare them every year. Can I receive emergency benefits?

No. The government requires that it must be work income, the same as question 1.

11. I am a college student, and the school cannot open. Can I apply for emergency benefits?

Yes. As long as you are still a college student in September this year (or a freshman who enrolled in September; or a college student who graduated in December 2019), and your monthly income is less than or equal to $1,000, you can apply for a monthly benefit of $1,250, and the application period is from May to August. If you take care of sick relatives during this period, there will be an additional $500 in welfare benefits per month.

12. I am a student. I have always worked during the summer vacation. This year, I can’t work during the summer vacation due to the epidemic. Can I apply for emergency benefits?

If you are a college student who meets the requirements, you can. But you can’t apply for $2,000 in benefits per month. You can apply for $1,250 in benefits per month.

13. Doesn’t HST give everyone a subsidy of about $400? Why don’t I have it? Do I need to apply for it extra?

First of all, there is no need to apply for HST epidemic subsidies, and the government will issue them directly. Secondly, not everyone has them. The government will only issue them to low- and middle-income families and individuals.

14. How to apply for the milk money subsidy?

No need to apply, the government will directly issue extra milk money to families with milk money in early May.

15. Emergency benefits, will the government automatically issue it every month after I apply once?

No. You need to apply separately in the month you are eligible.

16. I am an agent. The commission income from the February transaction order will be credited in April. Can I still apply for emergency benefits?

No.

17. Can I apply for a work permit or a study permit?

As long as you meet the requirements, you can apply. *There are news reports that international students are not eligible for the latest student emergency benefits, but AOE accountants have not obtained relevant information from the tax bureau documents. Let's wait for official updates for specific details.

18. Does the epidemic sick leave EI or emergency benefits require a doctor's certificate?

No.

19. I used to have a job, but now I can't work because of the epidemic, but I have rental income and investment income. Can I apply for emergency benefits?

Yes.

20. What should I do if I applied for emergency benefits that I do not meet the requirements?

You can write a check and return it to the tax bureau.

In the face of the epidemic, each of us is actually our own hero. We gave up our freedom and stayed at home to buy time and space for doctors and medical scientists.

In the face of the epidemic, each of us is actually a creator of history. We strive to prove to the future that as long as we are united and grateful, there is no difficulty that cannot be overcome.

Finally, I would like to remind everyone not to believe in rumors or spread them. Stay at home if you have nothing to do and avoid all overseas travel. If you have family and friends who are still overseas, please urge them to return home as soon as possible. Don't rush to buy daily necessities. Together, we will definitely be able to defeat the new coronavirus.

Whether you need to apply for EI, CERB or corporate benefits, a professional and responsible accounting firm is the most worthy of your trust.

For tax services, please look for CPA

During this special period, you only need to calmly protect the physical and mental health of yourself and your family, and the rest of the tax issues will be completed by our AOE CPA team.

Let's work together to get through this difficult time.

If you have any questions about taxation, please contact us. We will provide you with the most professional and comprehensive taxation advice.

Please call: 289-597-1869 or

Welcome to add our WeChat customer service number for detailed consultation:

AOE Taxation customer service number - aoetaxation

2020年的开年到现在信诚会计事务所(AOE Taxation Professional Corp.)的小编跟大家一起见证了无数个历史时刻。我们一起惋惜了巨星的陨落。我们一起见证了如水的石油。我们一起经历着疫情的肆虐。… …

最重要的是,我们一起感受着团结与爱的力量。从疫情开始政府一步步地推出了非常多的疫情福利来帮助大家一起渡过难关,今天AOE的小编帮大家整理了一份疫情福利的问答,希望可以帮助到每一个需要帮助到的人。*小编今天会把重点字色变为蓝色,来向一线的医护人员致敬。感谢他们付出的所有。

1.我2019年没有工作收入,但是我房租收入和投资收入超过了$5000,我可以申请紧急福利吗?

不可以。政府规定收入来源为:工资收入,自雇收入,产假EI收入

2.EI和紧急福利可否一起享受?

不可以。

3.疫情这么严重,所以我跟公司主动提出了辞职,我可以申请紧急福利吗?

不可以。

4.我过年回中国了,现在没办法入境加拿大,我可以申请紧急福利吗?

不可以。等回来之后,如果还符合条件,可以申请。

5.我的公司现在已经开始复工了,但是我的孩子们还是没办法上学,我需要在家照顾他们,没办法复工,我还可以继续申请紧急福利吗?

可以。只要你确定你在家照顾孩子的时候每月工作收入小$1000。

6.我自己的公司给自己开工资,我现在停止给自己开工资,我每个月就没有收入了。我可以申请紧急福利吗?

可以。但是我们不建议大家这么做,因为政府的紧急福利补助是给真正需要帮助的人。

7.我领取完了我的产假EI,但是因为疫情我没有办法回到工作岗位上,我可以申请紧急福利吗?

可以。

8.我领取完产假EI之后,申请了学生贷款,但是现在在家里照顾不能上学的孩子,我可以申请紧急福利吗?

可以。

9.申请紧急福利的$5000收入要求,一定是加拿大的收入吗?

不一定。可以是海外工作收入,但要在报税的时候申报海外工作收入。

10.我在加拿大没有海外工作收入,也没有加拿大工作收入。但是我有海外资产,我每年都有申报,我可以领取紧急福利吗?

不可以。政府要求的一定是工作收入,同问题1。

11.我是一名大学生,学校没有办法开学,我可以申请紧急福利吗?

可以。只要你今年9月依旧是大学在读学生(或者9月份入学的大一新生;或者2019年12月毕业的大学生),且月收入小于等于$1000,可以申请每月$1250福利,申请期间是5月到8月。如果在此期间照顾患病的亲人,每月还有额外$500的福利补助。

12.我是一名学生,我之前一直都有暑假打工,今年因为疫情暑假不能打工了,我可以申请紧急福利吗?

如果你是一名符合要求的大学生是可以的。但是你不能申请一个月$2000的福利,你可以申请一个月$1250的福利。

13.不是说HST给每个人都会补助$400左右吗?为什么我没有?是需要额外申请吗?

首先HST的疫情补助不需要申请,政府直接发放。其次不是每个人都有的,政府只会给中低收入的家庭和个人发放。

14.牛奶金补助怎么申请?

不需要申请,政府会在5月初给有牛奶金的家庭直接发额外牛奶金。

15.紧急福利,我是不是申请一次之后,政府每个月就会自动发放?

不是。在你符合的月份里需要单独申请。

16.我是中介,2月份成交单的佣金收入4月份到账,我还可以申请紧急福利吗?

不可以。

17.工签和学签可以申请吗?

只要符合条件的都可以申请。*有新闻报道,国际留学生不符合领取最新学生紧急福利资格,但AOE的会计师们并未从税局文件上获取到相关内容,具体细节我们一起等待官方更新。

18.疫情病假EI,或者紧急福利需要医生证明吗?

不需要。

19.我之前有工作,现在因为疫情没有办法工作了,但是我有房租收入和投资收入。我可以申请紧急福利吗?

可以。

20.申请了不符合条件的紧急福利怎么办?

你可以写支票退回给税局。

面对疫情其实我们每一个人都是自己的英雄。我们放弃了自由,待在家里,给医生和医学家们争取着时间和空间。

面对疫情其实我们每个人都是历史的铸造者。我们努力地向未来证明,只要团结且心存感激没有什么困难是不能渡过的。

最后提醒大家请大家不信谣,不传谣。没事不出门,避免一切出国旅行。有家人、朋友还在海外的,请尽快催促他们回国。购买生活必需品时不要哄抢。大家一同携手,我们必定能够战胜新型冠状病毒。

不管您是需要申请EI,CERB还是企业福利,专业负责的会计事务所最值得您的信赖。

税务服务,请认准CPA

在这个特殊的时期,您只需要从容安心地保护好自己和家人的身心健康,剩下的税务问题由我们AOE信诚的CPA团队来完成。

让我们一起加油渡过难关。

如果您在税务中有任何问题,欢迎联系我们。我们将带给您最专业,最全面的税务咨询,

请致电:289-597-1869 或

欢迎添加我们的微信客服号进行详细咨询:

信诚客服号 - aoetaxation

Due to COVID-19, the government has introduced many policies to help small business owners get through the difficult times. Many of these policies are related to the company's salary level. Many small business owners have realized the importance of salary, so recently, clients often ask about the difference between salary and dividends.

The certified public accountants of AOE Accounting Firm are here to explain the difference between salary and dividends, as well as the main advantages and disadvantages of each difference. We also provide some common schemes for your reference.

Salary Payment

When a company pays wages, wages are the company's expenses and the employees' active income-employees will have T4 slips. Salary expenses reduce the company's taxable income and reduce the company's tax payable.

To pay wages, the company needs to register a salary account with the CRA. Every time a salary is paid, the company needs to withhold CPP, EI (except shareholders and spouses) and income tax from the wages. Then these remittances are submitted to the tax bureau regularly. In addition, the company must prepare and submit T4 to the tax bureau before the end of February of the following year.

Why choose salary payment

Salary is a form of stable and predictable personal income.

Benefits of paying salary:

Dividends

Dividends are payments from a company's after-tax earnings to its shareholders. This means that dividends are not a company expense and do not reduce the company's tax liability. On the other hand, dividends may result in a lower personal tax rate than wages because of the Dividend Tax Credit (more on the tax difference below).

In practice, paying dividends to company shareholders is relatively easy. The company declares the dividend and transfers the cash from the company's account to the shareholder's personal account. The company must file a T5 with the tax office for the shareholder who received the dividend by the end of February of the following year.

The tricky thing about dividends is that they are paid and distributed based on share ownership. For example, if ABC Ltd. wants to pay a $100,000 dividend to owners of Class A common stock, it must distribute it based on the proportion of shares held. So if shareholder A owns 30% of ABC Ltd.'s Class A common shares and shareholder B owns the other 70%, shareholder A will receive $30,000 and shareholder B will receive $70,000. It is difficult to allocate different amounts of income to multiple shareholders if they all own the same class of shares.

Why choose dividends

Issuing dividends is an easy way for shareholders to take money out of the company.

The advantages of issuing dividends include:

Which method reduces taxes?

The most common question about wages vs. dividends is ”Which method allows me to pay less tax?

This is a very important question, and changes to the tax law that came into effect at the beginning of 2018 have made it more difficult to reduce taxes by choosing one method or another.

Before comparing the various wage and dividend models, you first need to understand the Canadian tax system.

Tax Integration

Canadian tax law implements a tax concept called ”integration”. The idea is that when comparing dividend payments and wage payments of the same amount, there should be no difference in the overall income tax paid (personal income tax + corporate tax).

How it works:

Dividend sprinkling

In the past, corporate shareholders could get around integration issues and use a method called dividend sprinkling to spread income and reduce taxes by distributing dividends to spouses or adult family members with lower incomes. Since the spouse or adult family member is in a lower tax bracket than the person running the business, the personal income tax paid on the dividend income will be reduced.

However, changes to the tax law that took effect in early 2018 make this approach more difficult to implement. Since dividends are more difficult to implement, it is particularly important to consider the qualitative factors discussed above when deciding which payment method to use.

Calculate and Compare Taxes

While the tax savings may not be as great as they have been in the past, we can still do some simple calculations to help determine if dividends or wages are more tax efficient.

The idea is to calculate the total taxes (corporate + personal) that will be paid when using dividends and compare it to the total taxes that will be paid when using wages. A tool such as the Simple Tax Calculator can be used to calculate personal tax estimates, and the corporate tax rate will also be needed to estimate corporate taxes. You can consult your accountant.

Common Scenarios

Finally, let's look at some common scenarios. We discuss each scenario below and may help company management make a better decision.

There are many things to consider when deciding whether to pay via salary or dividends. A professional and responsible accounting firm is the best place to put your trust.

For tax services, please look for CPA

During this special period, you only need to calmly protect the physical and mental health of yourself and your family, and the rest of the tax issues will be completed by our AOE CPA team.

Let's work together to get through this difficult time.

If you have any questions about taxation, please contact us. We will provide you with the most professional and comprehensive taxation advice.

Please call: 289-597-1869 or

Welcome to add our WeChat customer service number for detailed consultation:

AOE Taxation customer service number - aoetaxation

由于COVID-19,政府出台了很多政策帮助小企业主度过难关。这些政策很多都和公司的工资水平相关,很多小企业主意识到了工资的重要性,所以,最近经常有客户咨询工资和红利的区别。

信诚会计事务所的注册会计师在这里给大家讲解一下工资和红利的区别,以及每种差异的主要优缺点。我们还提供一些常见的方案,给大家参考。

工资发放

当公司支付工资时,工资是公司的费用,是员工的主动收入–员工会有T4单。工资费用减少了公司的应纳税收入,减少了公司应缴税款。

要支付工资,公司需要向CRA注册工资账户。每次支付工资时,公司都需要从工资中代扣代缴CPP,EI(股东及配偶除外)和所得税。然后定期将这些代缴款上交税局。此外,公司在次年的2月底之前必须准备并提交T4给税局。

为什么选择工资发放

工资是稳定并可预测的个人收入的一种方式。

发放工资的好处:

红利

红利是从公司的税后收入支付给公司股东的利润。这意味着红利不是公司费用,不会减少公司应缴税款。另一方面,红利带来的个人税率有可能比工资少,因为有红利税收抵免(Dividend Tax Credit)(下面更多的是关于税收差异的解释)。

实际上,向公司股东支付红利是相对容易。公司申报红利,并将现金从公司账户转入股东的个人账户。公司在次年的2月底之前必须为收到红利的股东提交T5给税局。

红利的棘手之处在于,红利是根据股份所有权发放和支付的。例如,如果ABC Ltd.想向A类普通股的所有者发放10万元的红利,它必须根据持股比例分配。因此,如果股东A拥有ABC Ltd.30%的A类普通股份,而股东B拥有另外70%的A类普通股份,那么股东A将获得3万加币,股东B将获得7万加币。如果股东都拥有同一类股份,则很难将不同数额的收入分配给多个股东。

为什么选择红利

发放红利是股东从公司取钱的一种简单方法。

发放红利的优势包括:

哪种方法可减少税收?

关于工资与红利的最常见问题是”哪种方法允许我少交税?

这是一个非常重要的问题,2018年初生效的税法修改案,使得通过选择一种或另一种方法来减少税收变得更加困难。